Message from the President and CEO

To our valued

Shareholders,

In my six years at Universal Robina Corporation, the last four have presented challenges unlike anything else in our storied history.

2020 to 2022 – the pandemic years – were a stark revelation of who we are, our values, and ability to rise to the occasion.

2023, with its attendant difficulties, brought into focus our ability to strategize, innovate, and adapt to trouble and change.

I write this message as we tackle inflation and consumer confidence. Such challenges are not alien to companies of our scope and size. The key, as with any challenge, is to respond with precision and determination, which have allowed us to find ways to continue URC’s growth.

Meanwhile, against this backdrop of global uncertainty, we have found ways to make URC thrive.

Yes, we’ve been battling unpredictable currents. The Philippines and many of our ASEAN markets have been wracked by inflation. Consumers have responded by spending less, significantly impacting local and regional business.

This, coupled with early difficulties posed by a complex system enhancement, plus the demands of warehouse improvements, created several high-pressure challenges in 2023 that tested our ability to reconfigure and adapt.

And yet here we are, surging upstream.

A combination of inspired portfolio management and pricing initiatives has allowed us to cope with inflationary pressures and grow our business.

Our commitment to technological transformation has kept us focused on the future, undistracted by present difficulties.

Creative decision-making, both easy and difficult, as well as strategic and tactical, were made with dual intent: to transform 2023 into a positive year and guarantee a sustainable business for many years to come.

In short, by adopting an evolutionary mindset and adapting to our situation, URC has weathered another challenging year, and I am pleased to report the results.

situation, URC has weathered another challenging year.

To our valued

Shareholders,

In my six years at Universal Robina Corporation, the last four have presented challenges unlike anything else in our storied history. 2020 to 2022 – the pandemic years – were a stark revelation of who we are, our values, and ability to rise to the occasion.

2023, with its attendant difficulties, brought into focus our ability to strategize, innovate, and adapt to trouble and change.

I write this message as we tackle inflation and consumer confidence. Such challenges are not alien to companies of our scope and size. The key, as with any challenge, is to respond with precision and determination, which have allowed us to find ways to continue URC’s growth.

Meanwhile, against this backdrop of global uncertainty, we have found ways to make URC thrive.

Yes, we’ve been battling unpredictable currents. The Philippines and many of our ASEAN markets have been wracked by inflation. Consumers have responded by spending less, significantly impacting local and regional business.

This, coupled with early difficulties posed by a complex system enhancement, plus the demands of warehouse improvements, created several high-pressure challenges in 2023 that tested our ability to reconfigure and adapt.

And yet here we are, surging upstream.

A combination of inspired portfolio management and pricing initiatives has allowed us to cope with inflationary pressures and grow our business.

Our commitment to technological transformation has kept us focused on the future, undistracted by present difficulties.

Yes, we’ve been battling unpredictable currents. The Philippines and many of our ASEAN markets have been wracked by inflation. Consumers have responded by spending less, significantly impacting local and regional business.

This, coupled with early difficulties posed by a complex system enhancement, plus the demands of warehouse improvements, created several high-pressure challenges in 2023 that tested our ability to reconfigure and adapt.

And yet here we are, surging upstream.

A combination of inspired portfolio management and pricing initiatives has allowed us to cope with inflationary pressures and grow our business.

Our commitment to technological transformation has kept us focused on the future, undistracted by present difficulties.

Creative decision-making, both easy and difficult, as well as strategic and tactical, were made with dual intent: to transform 2023 into a positive year and guarantee a sustainable business for many years to come.

In short, by adopting an evolutionary mindset and adapting to our situation, URC has weathered another challenging year, and I am pleased to report the results.

Business Review

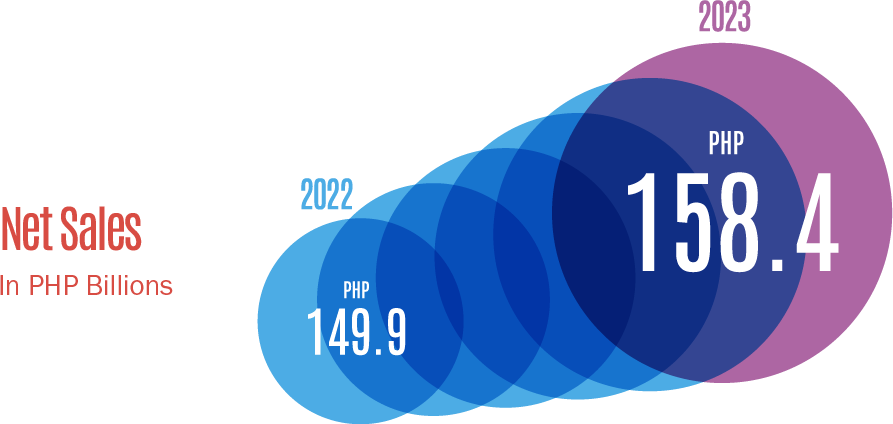

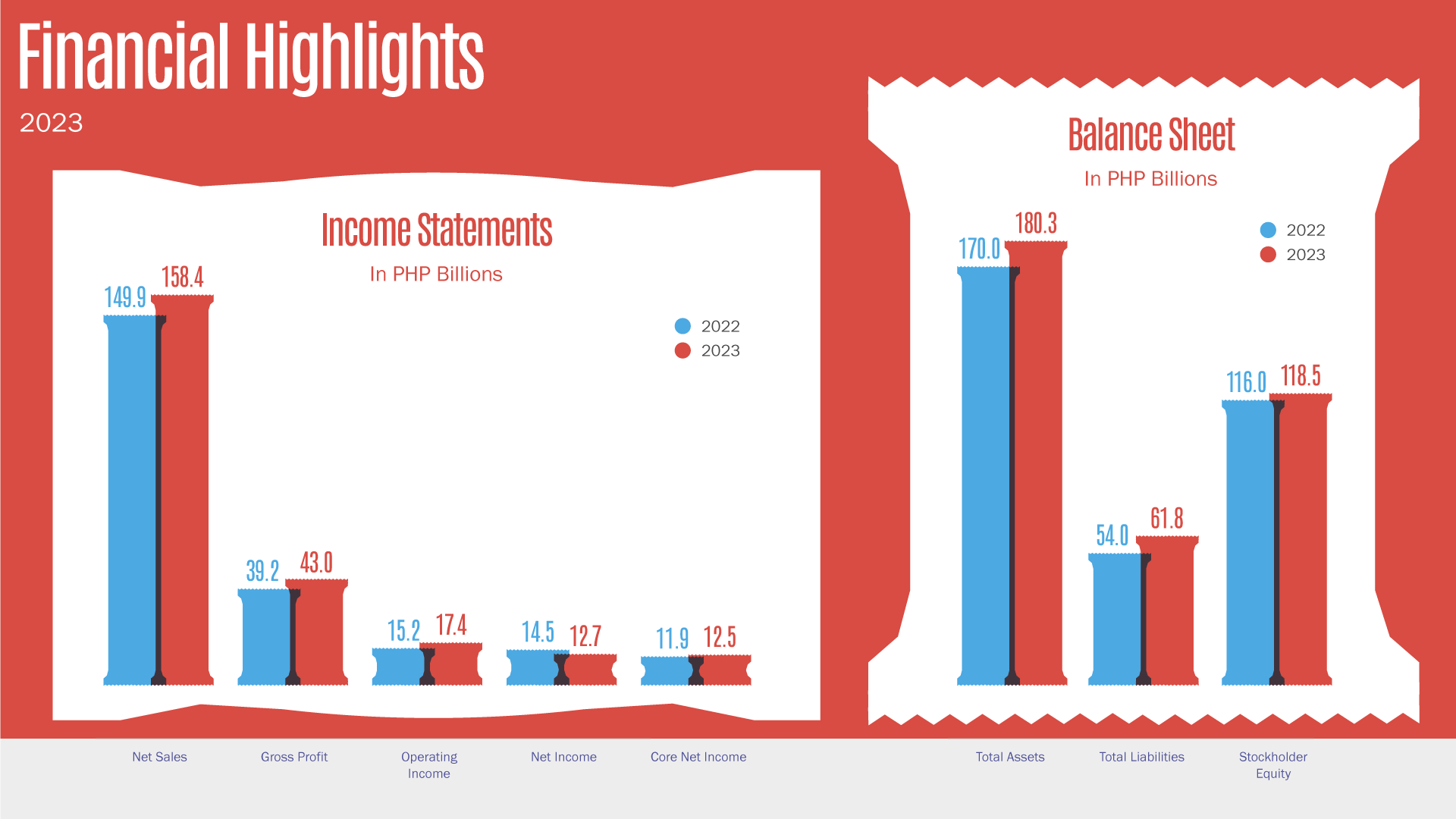

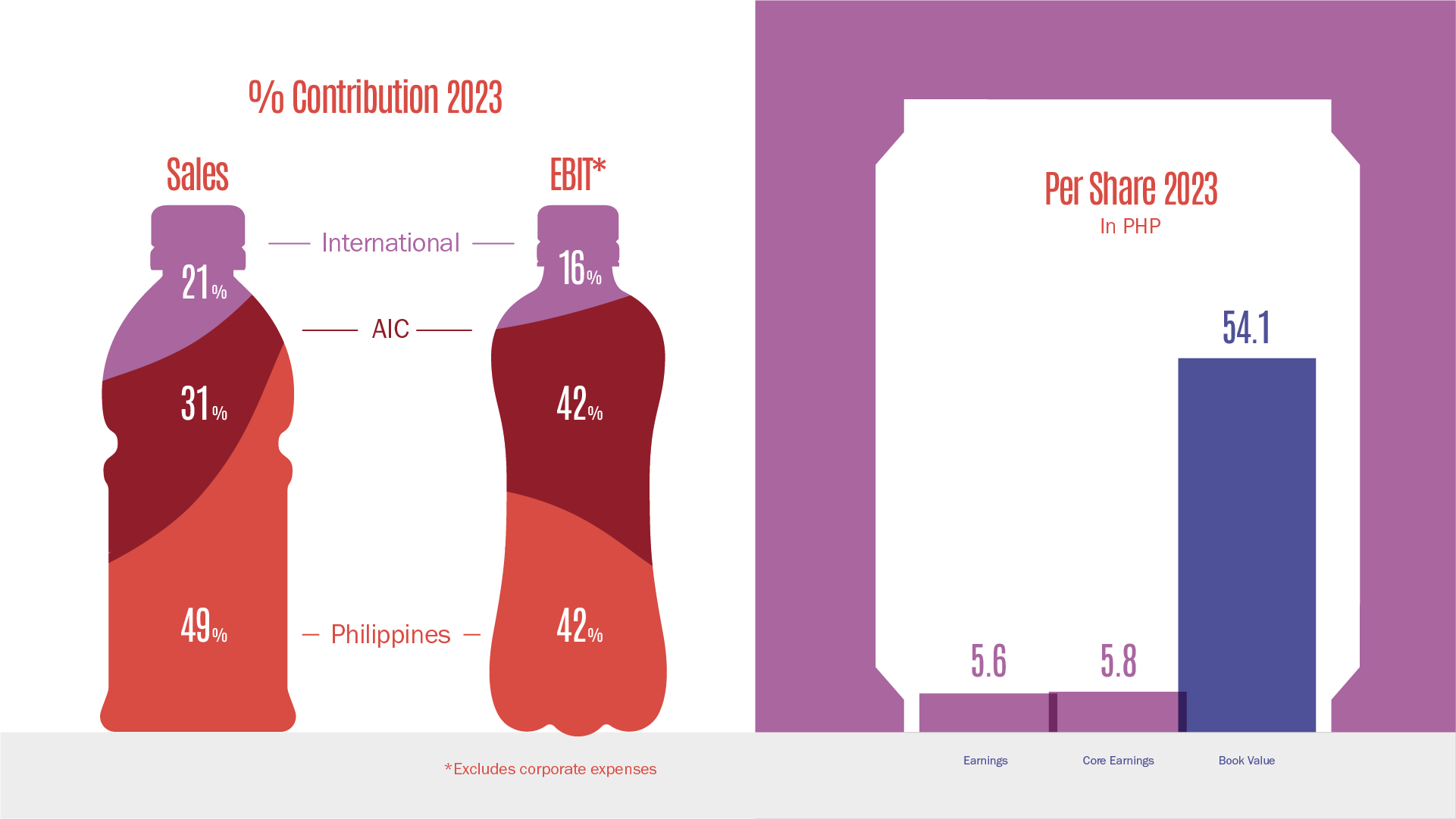

In 2023, URC closed the calendar year with a notable topline of Php158.4 billion, marking a 6% increase over the previous year’s robust growth of 28%.

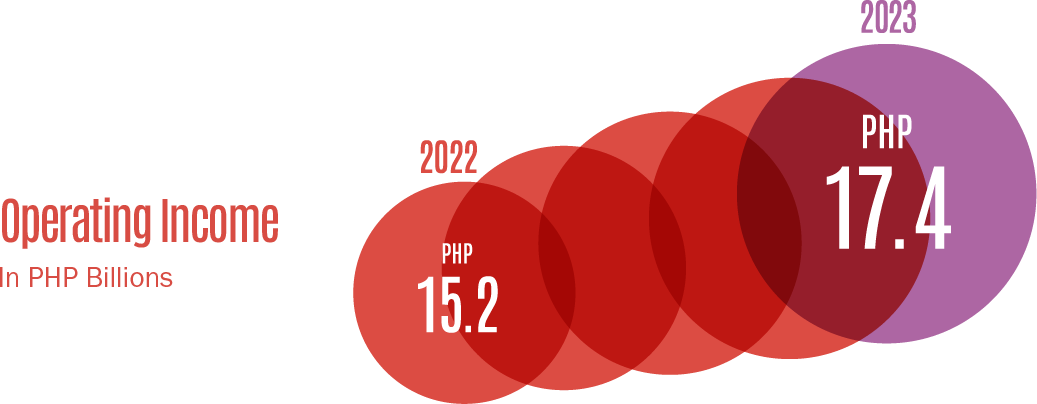

Our operating income saw substantial growth, reaching Php17.4 billion, up 14% on top of 2022’s 20% profit growth. Bottomline continues to significantly outpace topline growth, with all divisions accelerating margin recovery.

Throughout the year, our Fuel for Growth program exceeded expectations, surpassing initial targets for operational efficiencies and cost savings, thereby enhancing our margins.

Despite a challenging economic environment characterized by persistent high inflation and fluctuating input prices, we maintained resilience and delivered strong top and bottom-line performances.

Divisional Performance

Branded Consumer Foods (BCF) Philippines experienced a steady 3% growth compared to the previous year. We saw positive trends across various categories, particularly in Snacks and Ready-to-Drink beverages, which contributed to our overall growth.

Our operating income outpacetopline growth, increasing by 4% over the year. This growth was driven by strategic pricing adjustments and efficiency measures in our operations. These initiatives not only bolstered our brands but also helped us counterbalance costs.

By reinvesting in our business, we aim to further fortify our brands and ensure sustainable growth in the future.

Turning to BCF International, we’ve seen a 2% growth in sales compared to the same period last year, measured in peso terms.

Despite challenges in the consumer landscape, our core operations in Vietnam and Malaysia have shown strong growth. Additionally, Thailand and Indonesia have successfully rebounded from earlier challenges, experiencing growth in the fourth quarter compared to the same period last year and showing sequential improvement.

Our profitability has been particularly noteworthy, surpassing our sales growth with a remarkable increase of 26% compared to the same period last year. As a result, our operating margins have expanded to reach 10% for the full year, marking the first time we’ve achieved double-digit margins since 2019.

This demonstrates the resilience and efficiency of our international business despite market fluctuations and challenges.

Wrapping up our business unit reviews, our Agro-Industrial and Commodities (AIC) division has maintained impressive double-digit growth across its three core businesses.

Within our Agro-Industrial Group (AIG), strong performance was driven by significant volume and value growth, particularly in animal feeds and pet foods.

Meanwhile, our Commodities businesses have sustained their upward trajectory, with volumes expanding in Flour and market shares increasing in Sugar and Renewables.

Consistent with our other units, operating income for the AIC group surpassed topline growth, marking a substantial 20% increase compared to the same period last year. This growth was widespread across all business units, reflecting the effectiveness of our strategies.

Margins within the Agro-Industrial Group expanded thanks to improvements in scale, product mix, and reduced input costs. Flour margins also saw a boost from lower wheat costs, while Sugar margins began to stabilize as selling prices normalized.

Divisional Performance

Branded Consumer Foods (BCF) Philippines experienced a steady 3% growth compared to the previous year. We saw positive trends across various categories, particularly in Snacks and Ready-to-Drink beverages, which contributed to our overall growth.

Our operating income outpacetopline growth, increasing by 4% over the year. This growth was driven by strategic pricing adjustments and efficiency measures in our operations. These initiatives not only bolstered our brands but also helped us counterbalance costs.

By reinvesting in our business, we aim to further fortify our brands and ensure sustainable growth in the future.

Turning to BCF International, we’ve seen a 2% growth in sales compared to the same period last year, measured in peso terms.

Despite challenges in the consumer landscape, our core operations in Vietnam and Malaysia have shown strong growth. Additionally, Thailand and Indonesia have successfully rebounded from earlier challenges, experiencing growth in the fourth quarter compared to the same period last year and showing sequential improvement.

Our profitability has been particularly noteworthy, surpassing our sales growth with a remarkable increase of 26% compared to the same period last year. As a result, our operating margins have expanded to reach 10% for the full year, marking the first time we’ve achieved double-digit margins since 2019.

This demonstrates the resilience and efficiency of our international business despite market fluctuations and challenges.

Wrapping up our business unit reviews, our Agro-Industrial and Commodities (AIC) division has maintained impressive double-digit growth across its three core businesses.

Within our Agro-Industrial Group (AIG), strong performance was driven by significant volume and value growth, particularly in animal feeds and pet foods.

Meanwhile, our Commodities businesses have sustained their upward trajectory, with volumes expanding in Flour and market shares increasing in Sugar and Renewables.

Consistent with our other units, operating income for the AIC group surpassed topline growth, marking a substantial 20% increase compared to the same period last year. This growth was widespread across all business units, reflecting the effectiveness of our strategies.

Margins within the Agro-Industrial Group expanded thanks to improvements in scale, product mix, and reduced input costs. Flour margins also saw a boost from lower wheat costs, while Sugar margins began to stabilize as selling prices normalized.

One of the great joys of leading URC is watching how we launch exciting new products to address shifting consumer habits and tastes.

Other Updates

One of the great joys of leading URC is watching how we launch exciting new products to address shifting consumer habits and tastes.

In 2023 we released a variety of offerings, including Great Taste Cream-O and Dewberry Yogurt Cake. As the names suggest, these products blend our most popular brands into “super brands”, generating fresh consumer interest and unexplored markets.

We also launched healthier products to address the growing demand for nutritious offerings (Jack ‘n Jill Nova Greens; Blend 45 Malunggay) and intriguing, limited edition products (Piattos Truffle Cream, Presto Premium).

These and other products leveraged our most beloved brands, giving customers dynamic new choices, and more reasons to love URC.

On Regulation and

Sustainability

We always pay attention to emerging regulatory trends outside of Asia, as they often influence Philippine policy; this outside-looking viewpoint allows us to upgrade our portfolio accordingly, well ahead of any required regulations. Our two pronged internal wellness program, risk reduction and enhanced wellness, guides us in how we respond to such policy developments, particularly in health and well-being.

Several URC products have benefited greatly from this program, undergoing adjustments in ingredients and formulation, to satisfy the demand for enhanced, forward thinking products.

Key to this is our commitment to reaching our sustainability targets. Our focus on six key areas remain the same: People and Communities, Climate Action, Water, Product, Packaging, and Sourcing, all of which align with UN Sustainable Development Goals.

Every decision we make at the company is filtered through one or more of these lenses.

Whether it’s refining our product portfolio, packaging, and sourcing to meet higher sustainability standards, or improving local living conditions, enhancing water usage protocols, and reducing our carbon footprint, we work with a mindfulness that brings out the best in our people and planet. A particularly proud moment for us in 2023 was when URC won two awards at the inaugural ESG Business Awards, held in Singapore last November.

The Job Creation award was bestowed on Flourish Pilipinas: The CEO Initiative, URC’s learning enhancement competition that awarded six young bakers with generous start-up packages. Flourish Pilipinas is an important part of URC’s drive to support a new wave of CEOs leading their own baking businesses.

Meanwhile, Project LTE (Laminates to Energy), URC’s first waste co-processing initiative, won the Industry Energy Efficiency award. This was in recognition of our shift to a more sustainable plastic waste management system, which saw hundreds of tons of waste directed to co-processing plants instead of landfills.

Adapting for a

Sustainable Future

Good business discipline involves adaptability, a willingness to evolve and modify one’s approach during unpredictable times. URC has proven, in 2023, that this is the way to thrive in an ever-changing world.

It also helps to remember that we are closer to being a fully sustainable global enterprise. We’ve always talked about being in transition between what we are today and what we hope to be tomorrow. But as the facts and awards bear witness, we are making great progress in our sustainability journey.

We’re continuously setting talented people and processes in place to streamline operations and strengthen our organizational capability.

By prioritizing our system transition, we’ve made strides in future-proofing our business, knowing that tomorrow’s success depends on how we innovate and prepare today.

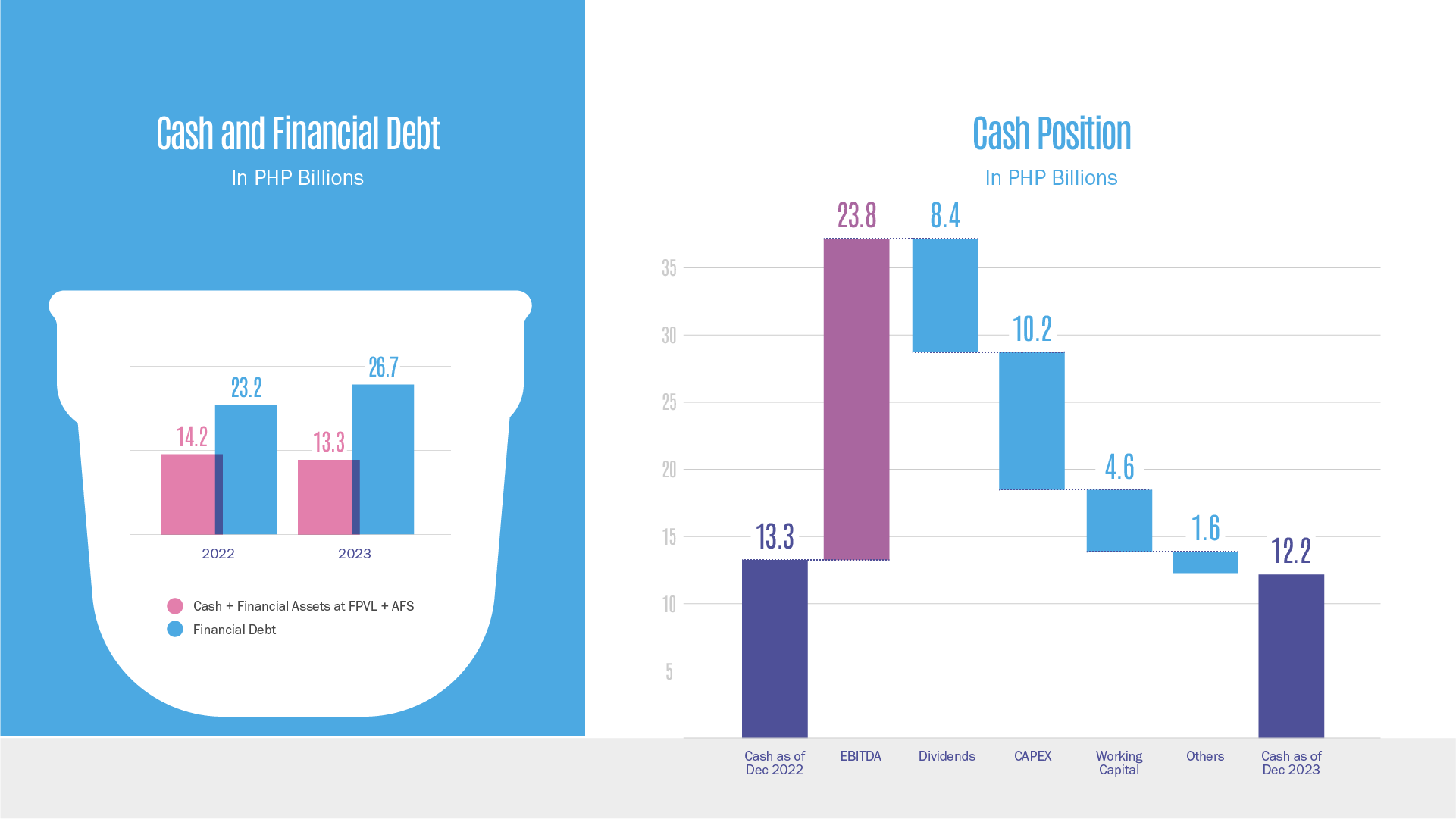

Meanwhile, by implementing price initiatives and launching new products to address changes in consumer buying habits, we’ve been able to strengthen our financial cash position and enhance our business.

This is how we’ve managed the turbulence of global markets, by being both a proficient and adaptive company. And as we have demonstrated in 2023, URC’s core values, multi-pronged strategies, commitment to tech evolution, and sheer determination, have kept us coursing upstream.

We are deeply grateful for your continued trust, support, and belief in what we do at URC.

Irwin C. Lee

President and

Chief Executive Officer